Overview

Sweep&Go makes it easy to calculate your payroll report. Payroll supports the weekly, bi-weekly, twice per month and monthly periods and does not calculate tax withholdings which are typically handled by your accountant or payroll processor. Payroll report is made independent of any payroll processor but if you are looking for one, you may consider ADP.

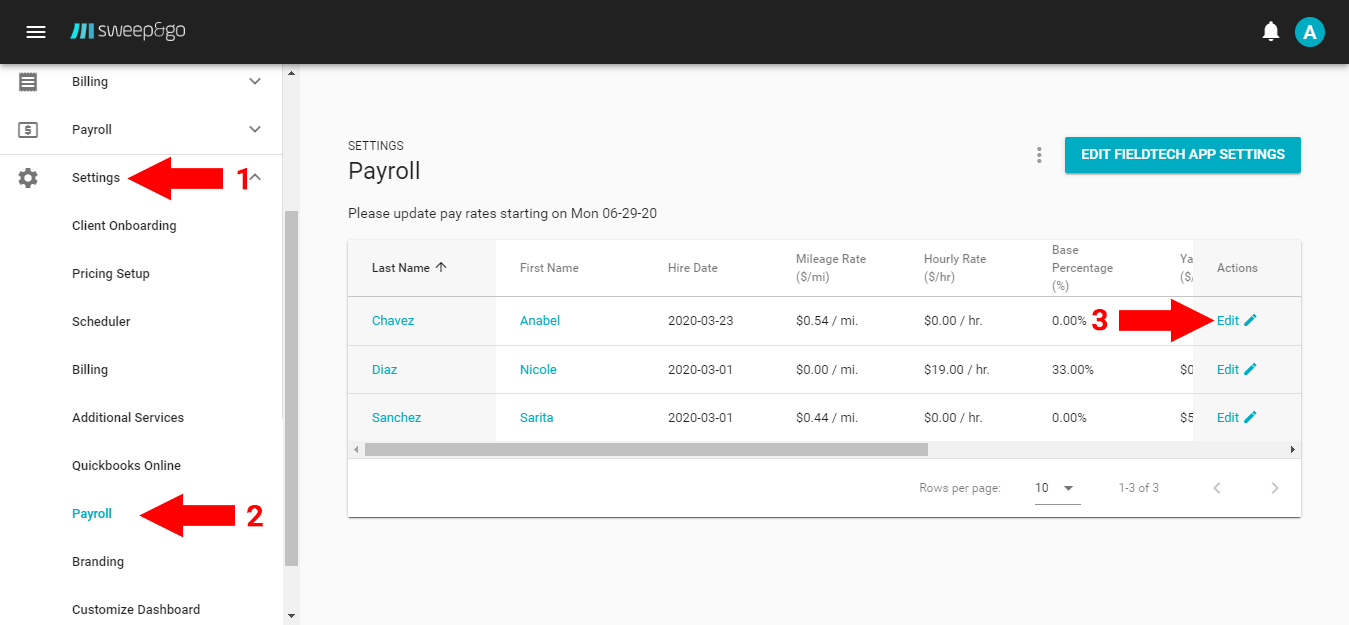

Update Payroll Settings

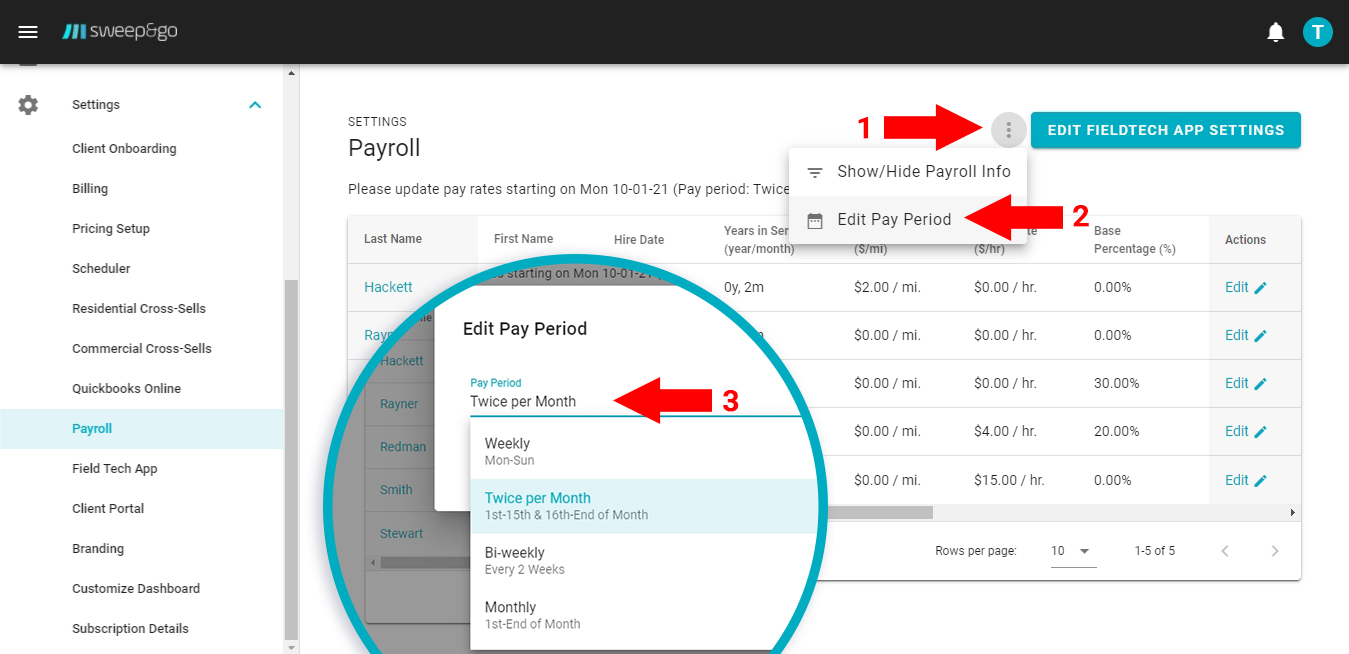

Before you create pay slips and use the payroll report, you first have to edit your staff compensation and possibly pay period. Go to Employee portal > Settings > Payroll.

To set your pay period click on three dots > Edit Pay Period > Select pay period > Save.

Set your pay period

To enter your staff compensation, click on Edit in the Actions section.

Sweep&Go supports 3 main payroll methods:

- Pay per Hour + Base Percentage which is suitable if you pay staff a) hourly, b) commission or c) hourly with potential performance bonus.

- Pay Per Yard which is suitable if you compensate staff per yard

- Fixed Pay which is suitable if you compensate staff a fixed amount

You may use several compensation options at once for your company meaning that some staff may be paid hourly and other staff could be paid hourly plus bonus, etc.

Mileage Rate ($/mi)

If your tech drives a personal vehicle and you wish to reimburse them for reported mileage, enter an amount greater than 0.

Payroll Methods

Sweep&Go offers 3 different payroll methods:

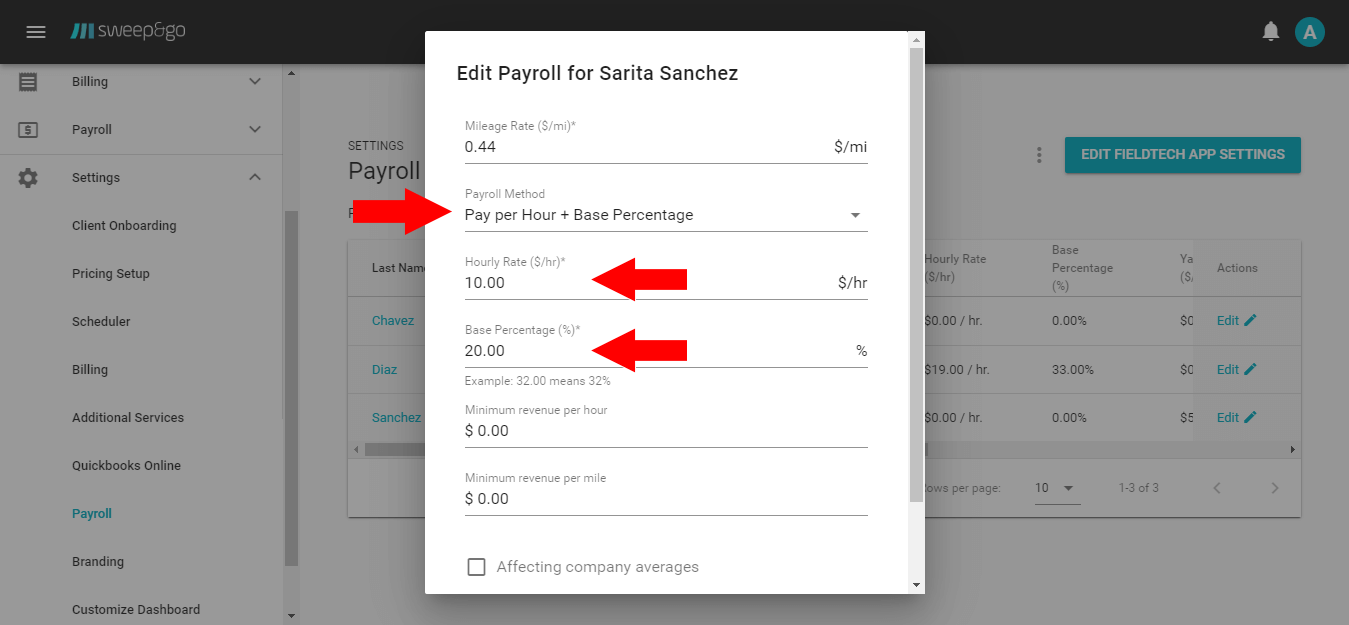

Pay per Hour + Base Percentage

Use this payroll method if you pay staff a) hourly, b) commission or c) hourly with potential performance bonus.

If you pay staff hourly, enter the hourly rate and keep base % as 0. For example, if a staff member has an hourly rate of $15/hr and he worked 30 hours, then his calculated weekly pay would be $450.

If you pay staff commission, enter the base % value and keep hourly rate as $0. For example, if a field tech generated $1,000 within a week for a business and his base % is 30%, then his calculated commission would be $300.

If you pay staff hourly with a potential performance bonus, then enter both hourly rate and base percentage. If the calculated hourly rate is lower than calculated commission, then the field tech would be paid commission. On the other hand, if the calculated hourly rate is higher than the calculated commission, then the field tech would be paid the hourly rate. For example, a staff is paid $15/hr and worked 20 hours which would make it $300 hourly pay. If he was paid only % of revenue, his income would possibly be $350. In this case considering that his performance is higher than expected, he’d be paid a higher amount of $350. On the other hand, if his hourly pay was $350 and his commission was $320, then he’d still be paid $350.

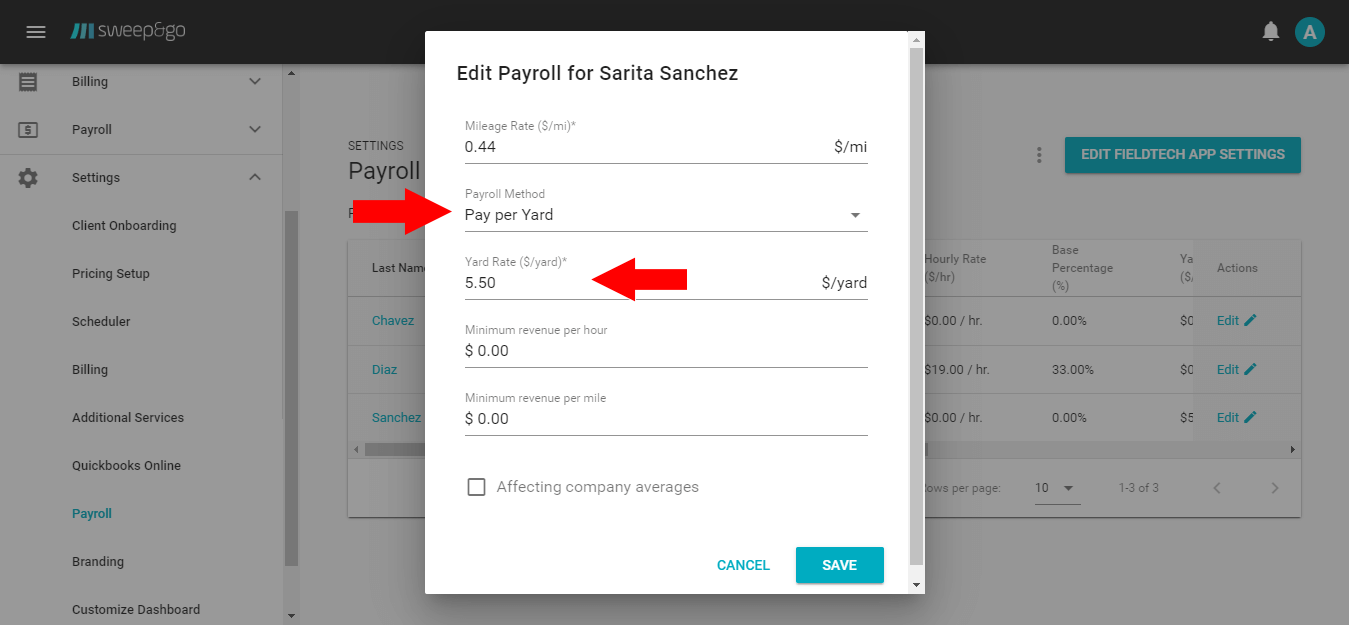

Pay Per Yard

Use this payroll method if you compensate staff per yard. Please note that staff are paid 100% for skipped cleanups as well but you may make adjustments when creating payslips. For example, if you pay a staff member $4 and they complete 100 yards within a week (Mon-Sun), then their yard compensation will be $400 for that week.

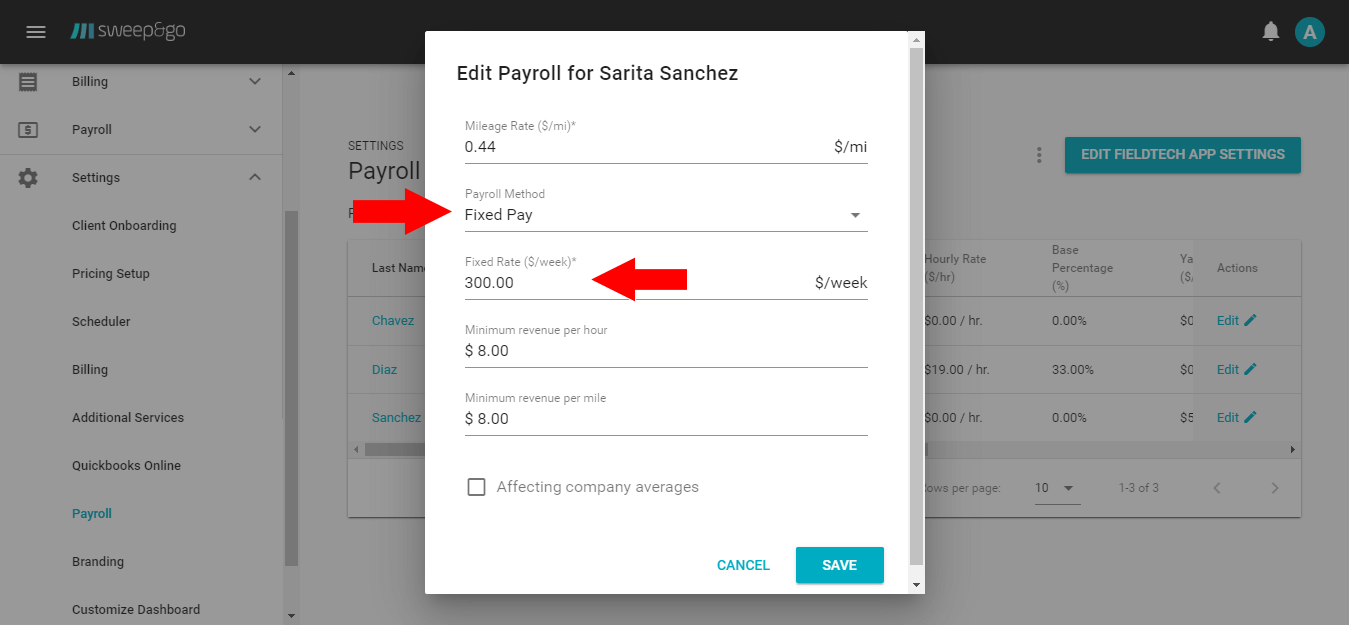

Fixed Pay

Use this payroll method if you compensate staff a fixed weekly amount. For example, if you pay staff a fixed weekly rate of $400, she will still be paid the same independent of hours worked or yards completed.

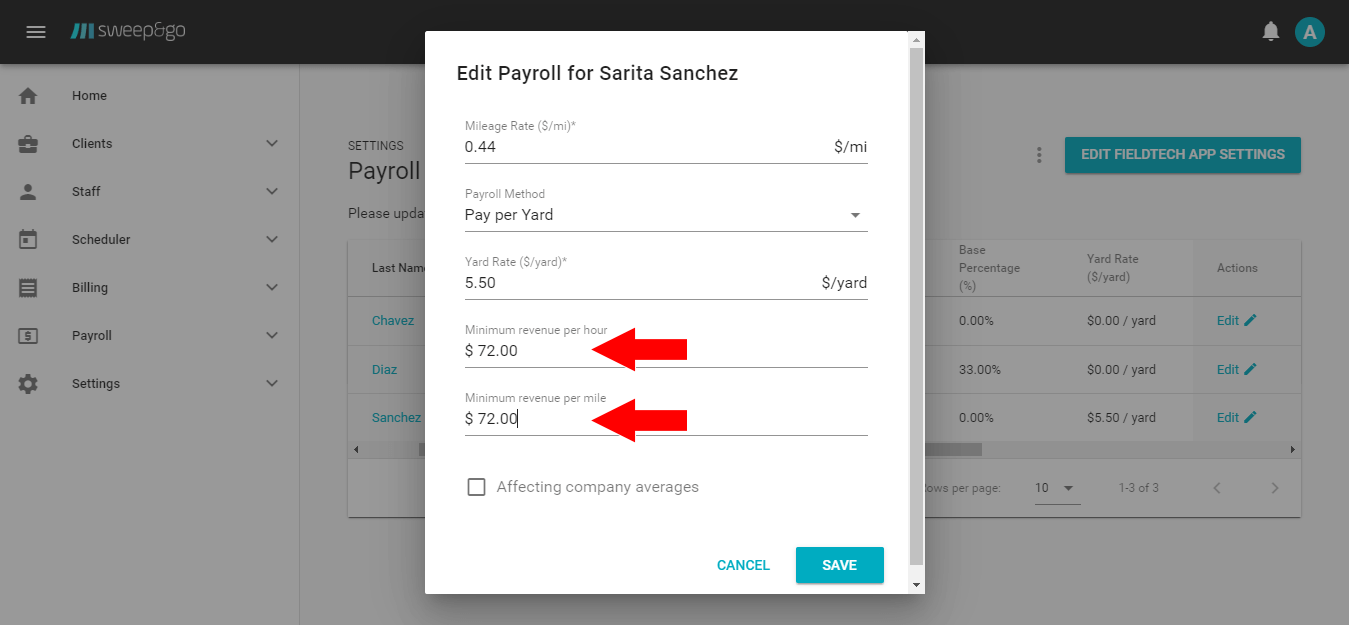

Minimum Revenue per Hour/Mile

Minimum revenue per hour and mile are target metrics you’d like to achieve for a particular field tech. These metrics would show within the field tech productivity report.

This is useful because you can then easily compare your field tech actual revenue per hour and revenue per mile compared to minimum targets and if not met, you could investigate route density, field tech performance issues, etc.

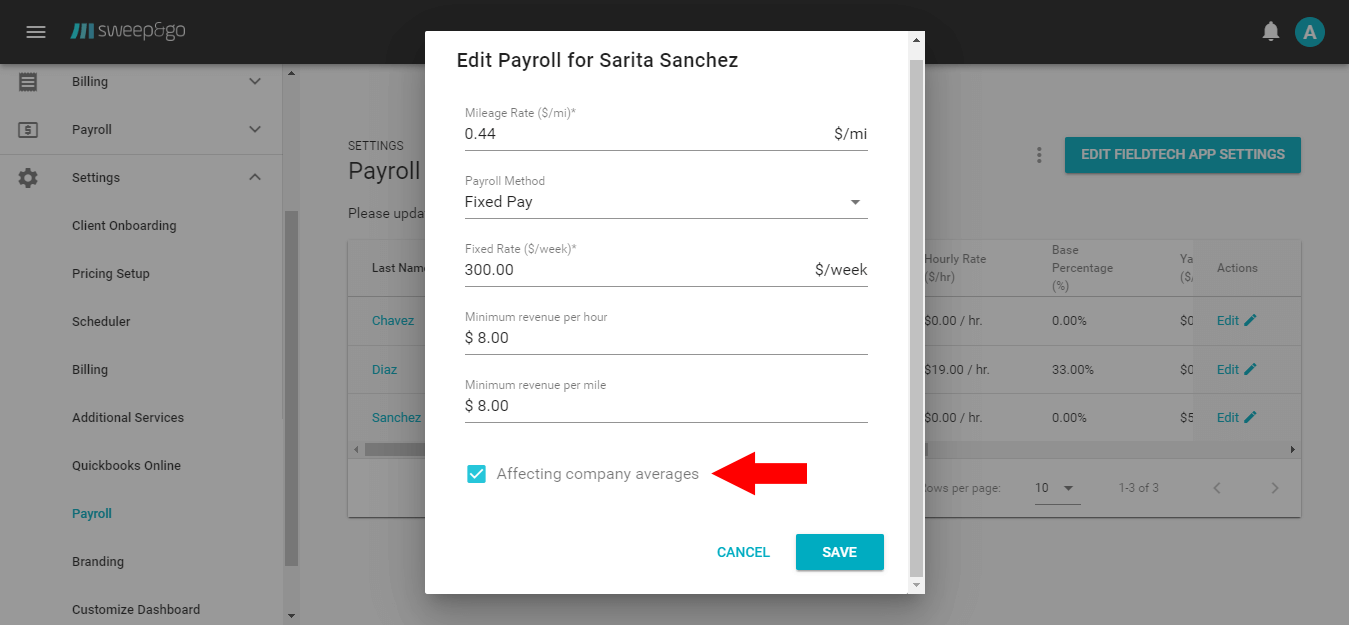

Affecting Company Averages

If checked, staff revenue per hour and revenue per mile will affect the company averages.

For example, if you have a staff member who mostly sits in the office and does very little field work on demand, it’s better to exclude such person from the company averages.

(!) When you update payroll settings, your changes will affect the next week’s payroll report for the current week pay period.

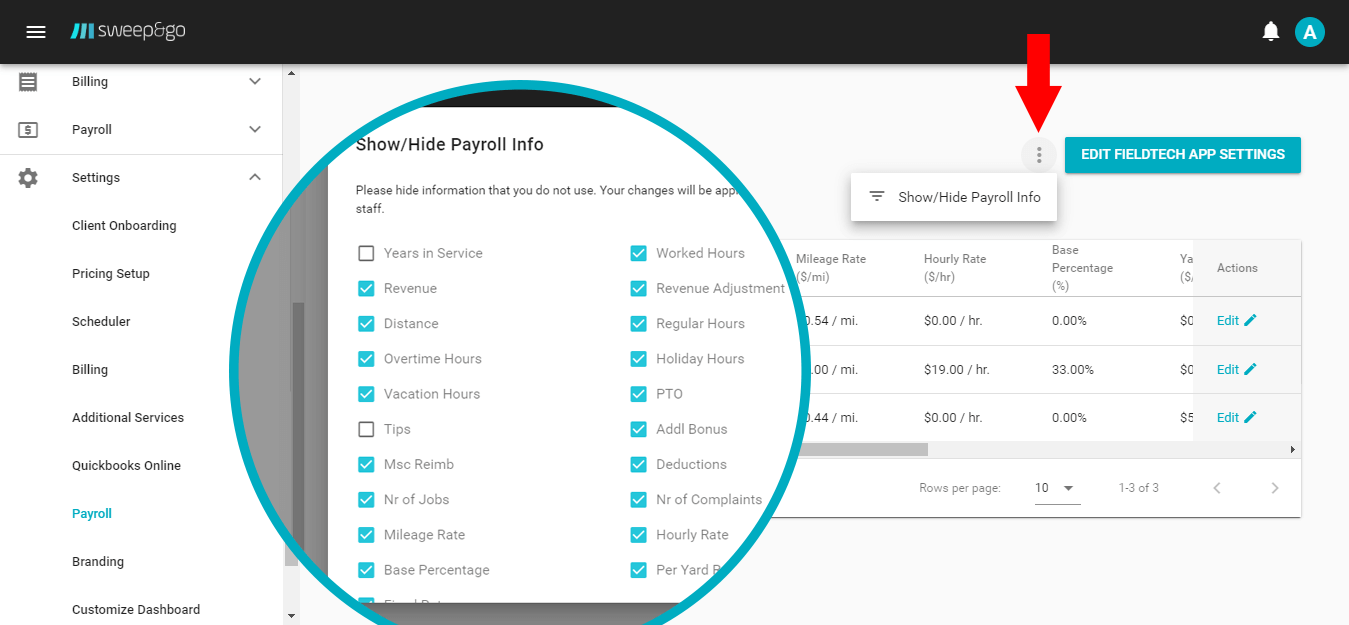

Show/Hide Payroll Info

If you do not use certain information for your payroll, you may hide it from displaying. For example, if you don’t reimburse your staff for mileage, you may uncheck the mileage rate from displaying.