Tracking Financial Information for Tax Purposes

Sweep&Go is not a financial software (example: QuickBooks Online) but in this tutorial, you’ll learn how to track important financial information for tax purposes using Sweep&Go. Discover how to calculate total invoiced amount, payments received, payouts received and sales tax reports.

- total amount you invoiced within certain time period

- Step 1: Go to Billing > Recurring Invoices > Set filters correctly (Date range, Invoice Type, etc then Go)

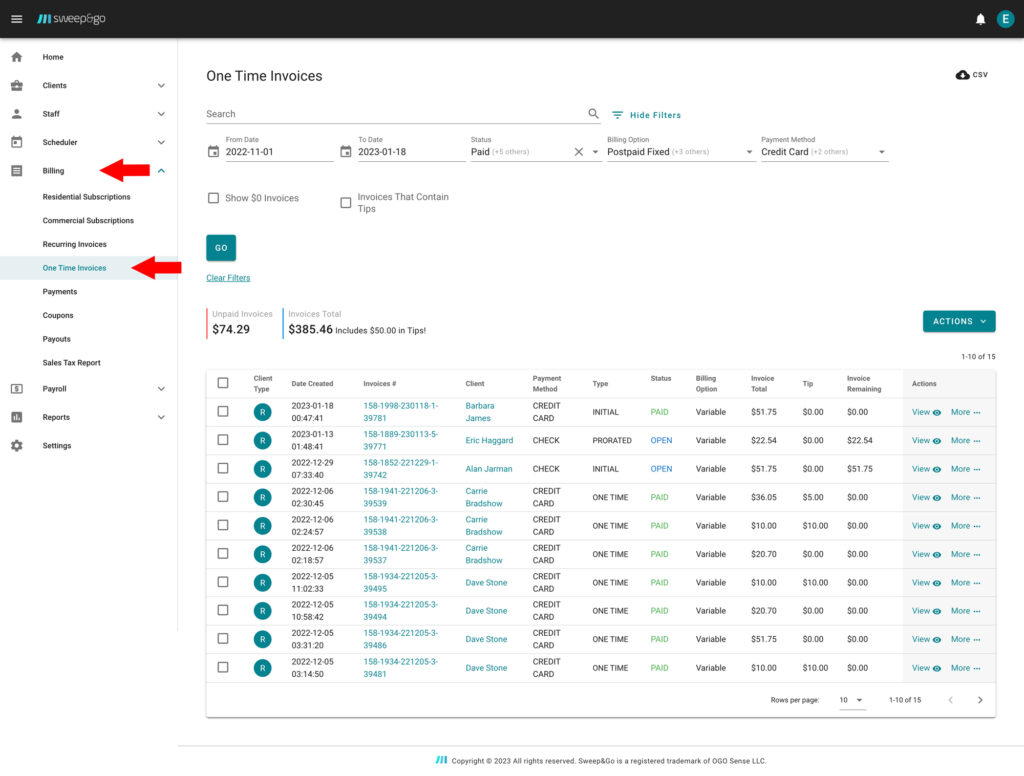

- Step 2: Go to Billing > One Time Invoices > Set filters correctly (Date range, Invoice Type, etc then Go)

- Step 3: Sum Both Recurring and One Time Invoice Totals

Example of One Time Invoice Total

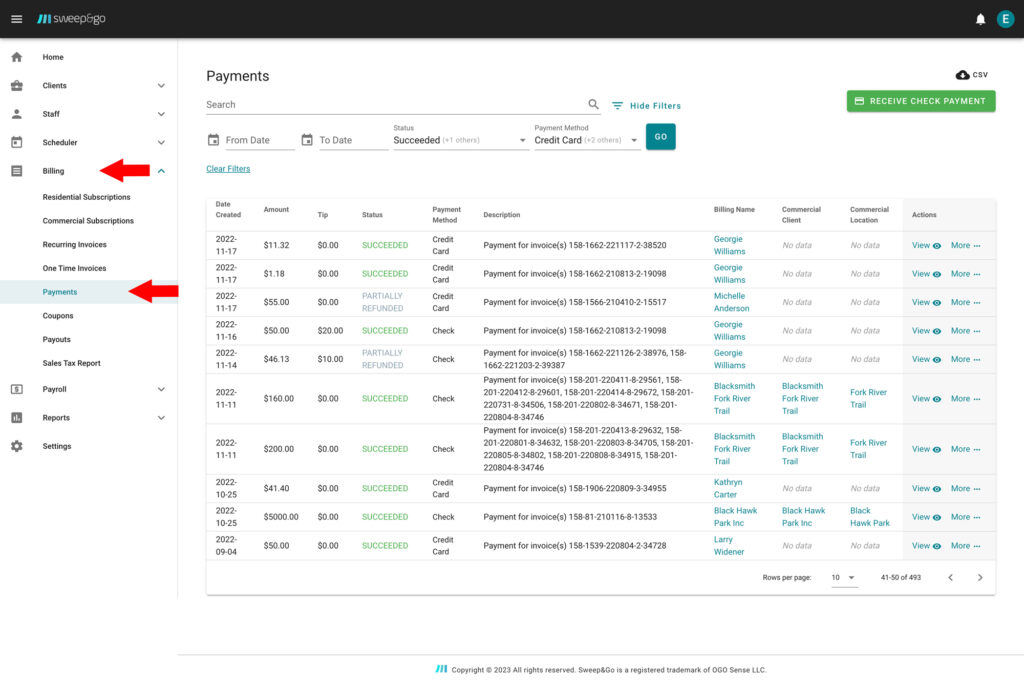

- total amount of payments received

- Go to Billing > Payments > Set filters correctly

You would want to track succeeded and partially refunded payments

Total amount of payments is calculated in the spreadsheet after you export the CSV file.

For partially refunded payments you would need to calculate the amount remained after the refund manually. You may see the refunded amount if you click on the view icon next to payment.

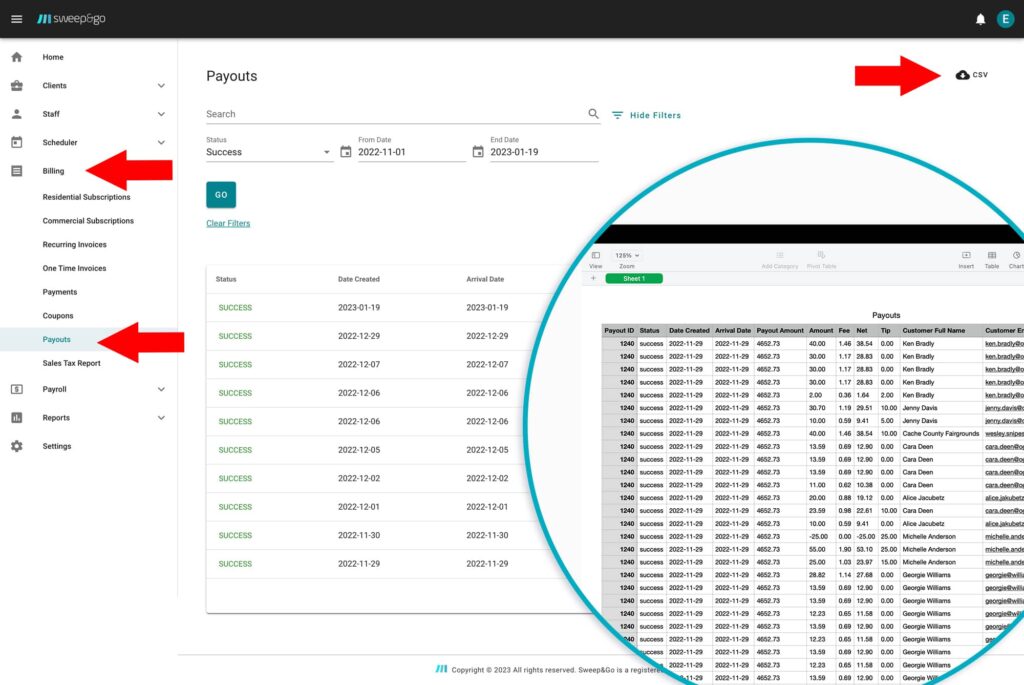

- total payouts received

- Go to Billing > Payouts > Set filters correctly

Export CSV file for total payouts amount

Here you may see credit card transactions processed by your payment processor (Fiserv and/or Stripe) and total amount of processing fees.

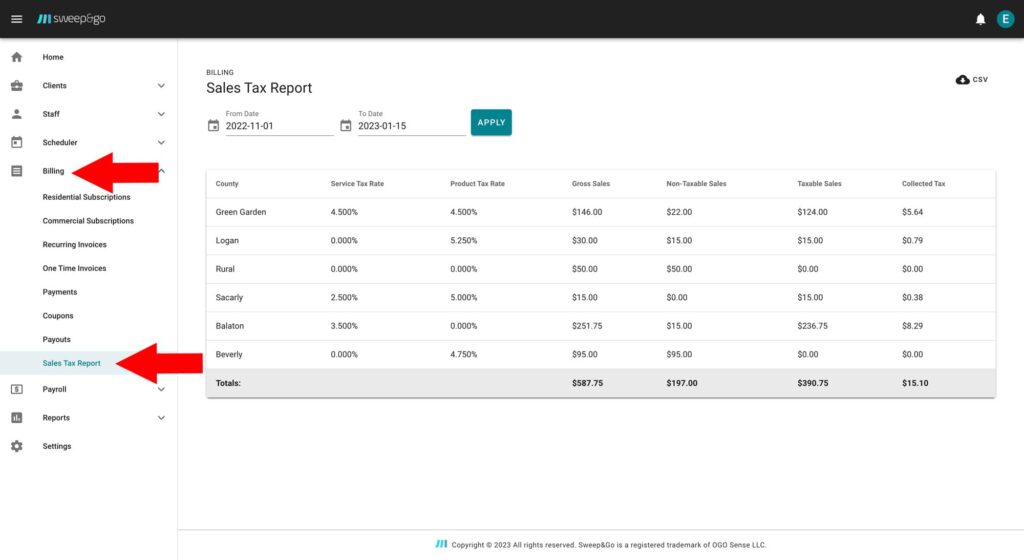

- sales tax report for those who are required to collect the sales tax

- Go to Billing > Sales Tax Report

Use it for reporting the collected sales tax

Here you may see your taxable and non-taxable sales, as well as export CSV file if needed.